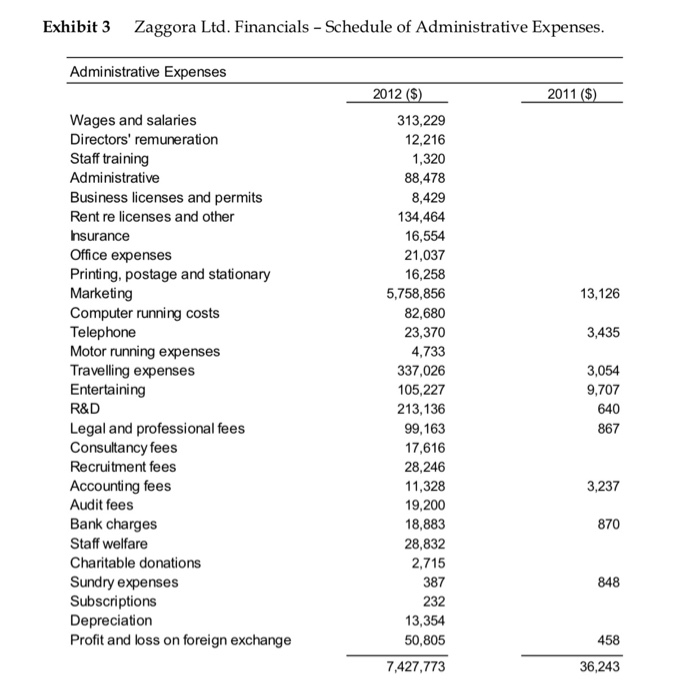

Useless on their own, G&A expenses fit into the overall efficiency of the business through revenue. To better understand G&A expenses, it’s important to provide more context. Measuring General and Administrative Expense Fees and interest are also kept as a separate one-line item on any income statement. The costs associated with manufacturing the product or service, for example, as well as a company’s investment expenses are categorized differently from G&A expenses. Other examples of common G&A expenses include: This is because operational fees are a fixed cost that occur with or without sales. Marketing costs are also noted in the general and administrative expenses section of accounting. These are the costs associated with running a business and keeping the employees comfortable. G&A expenses have no direct impact on the profit (thus are indirect costs) but instead refer to the efficiency of the business.įor example, general and administrative expenses include rent, utilities, insurance, salaries, and more. “Selling General Administrative Expense (SG&A): $2500” Examples of General and Administrative Expensesīut in reality, they are completely separate. Sales, general, and administrative expenseĪs you may have noticed above, general and administrative expenses are often lumped with sales on a company’s income statement as:.Main Types of Expensesīroadly speaking, a company would have three main types of expenses: So, these business expenses must be controlled from the very beginning. While sales and revenue can be variable, the general and administrative expense is a fixed constant. And yet, 41% of small businesses refer to cash flow problems as one of the primary obstacles for growth. G&A expenses are important since they directly affect cash flow. Instead, they involve every (often necessary) overhead incurred by a company.

G&A expenses are not related to manufacturing, production, or sales.

G&A expenses are a subset of the company’s operating expenses, excluding selling costs. General and administrative (G&A) expenses are common costs that allow a business to run properly, and may not be tied to a specific department or unit of a company. What are General and Administrative Expenses?

0 kommentar(er)

0 kommentar(er)